Discover Hard Cash Lending for Your Property Financial Investment Needs

Recognizing the subtleties of tough money financing can offer a competitive side in the real estate market, allowing financiers to seize chances that may or else be out of reach. As we delve right into the realm of difficult cash lending and its advantages, it ends up being noticeable that this financial tool holds the prospective to transform the method financiers approach their actual estate endeavors.

What Is Hard Cash Financing?

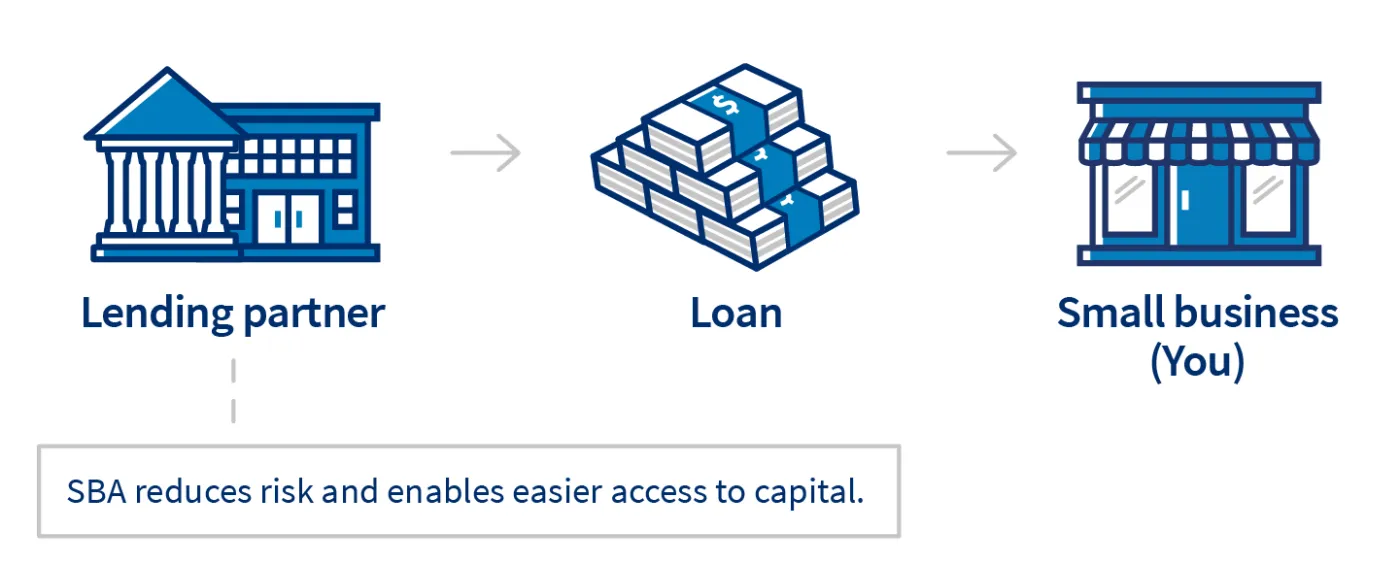

Hard cash lending is a specific kind of funding that is typically utilized in property transactions. Unlike conventional small business loan, hard money lendings are usually provided by exclusive financiers or companies and are protected by the value of the property being purchased. These loans are typically used by actual estate investors that need fast access to funding or that may not get conventional financing because of credit history issues or the unusual nature of their financial investment tasks.

Advantages of Hard Cash Loans

An additional benefit is the versatility that tough money fundings use. These financings are not subject to the exact same strict regulations and standards that standard lending institutions enforce. This adaptability permits even more innovative funding remedies and can be especially useful genuine estate capitalists who might not fulfill the rigorous needs of financial institutions. In addition, tough money loans can provide accessibility to funding for customers with less-than-perfect credit history, enabling a more comprehensive series of capitalists to take part in genuine estate endeavors. In general, the advantages of tough cash fundings make them a useful tool for investors looking to confiscate chances in the realty market.

How to Get Hard Money

When seeking to certify for hard money providing in real estate investments, comprehending the vital criteria and demands is crucial for prospective borrowers. To qualify for a hard cash financing, debtors should be prepared to give details regarding the home's worth, including an assessment or current purchase cost.

Additionally, hard money lending institutions might call for borrowers to have a down repayment or equity in the building, generally varying from 20% to 30%. Evidence of earnings or ability to make regular monthly rate of interest payments may likewise be needed. While difficult money financings provide faster funding and more flexibility have a peek here than traditional loans, prospective consumers need to recognize the higher rates of interest and much shorter funding terms connected with this type of financing. By fulfilling these qualification criteria and understanding the unique facets of tough money financing, capitalists can take advantage of this type of funding for their property projects.

Finding the Right Hard Cash Lending Institution

Situating the suitable difficult money lending institution for your realty investment needs needs thorough research study and cautious evaluation of different financing choices readily available out there. To locate the right hard cash lender, start by recognizing your particular investment demands and goals. Try to find lenders who focus on the type of residential property you want, whether it's residential, business, or land.

Following, take into consideration the track record and track document of possible lenders (georgia hard money loans). Seek out evaluations, testimonials, and references from other real estate capitalists who have actually collaborated with them in the past. A reputable hard cash loan provider must have a clear process, clear terms, and a history of successful offers

Furthermore, contrast the rates of interest, charges, and funding terms supplied by various loan providers to guarantee you are getting an affordable offer that straightens with your financial strategies. It's additionally important to examine the lender's flexibility, responsiveness, and desire to collaborate with you throughout the investment procedure. By performing detailed due persistance and exploring your options, you can locate the right tough money loan provider to sustain your realty ventures.

Tips for Successful Actual Estate Investments

To achieve success in realty investments, strategic planning and detailed market analysis are necessary parts. It is crucial to set clear investment goals. Whether you aim for lasting rental revenue, quick flips, or building admiration, defining your purposes will assist your choices throughout the investment process. Furthermore, conducting detailed market research study is crucial. Understanding local market trends, residential or commercial property pop over to this site worths, and rental demand will certainly aid you identify rewarding chances and make educated investment options.

Moreover, constructing a reliable network of real estate professionals can substantially profit your financial investment ventures. georgia hard money loans. Establish links with genuine estate representatives, service providers, building managers, and other market experts to obtain useful insights and assistance for your investments.

Last but not least, continually enlightening on your own regarding realty trends, guidelines, and investment approaches will certainly empower you to adapt to market changes and maximize your financial investment returns. By following these tips and continuing to be proactive in your technique, you can enhance your chances of success in real estate financial investments.

Final Thought

In final thought, tough cash lending deals an one-of-a-kind financing option for genuine estate Full Report capitalists looking for quick access to funding. Recognizing the advantages of difficult money finances, getting approved for them, and discovering the appropriate lending institution are essential actions for effective real estate financial investments. By utilizing hard cash lending, capitalists can make use of opportunities that conventional financing might not accommodate. Consider discovering difficult money offering as an important device for your property financial investment requirements.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/7ZSUGAL45JCLZCQJY753CX5A2E.jpg)